Ways to Avoid Common Small Business Accounting Errors

- mariahernandaz58

- Mar 15, 2020

- 3 min read

Nowadays, modern technology made accounting quite easier than ever before. Accounting mistakes are still a common issue and they cost your business money, lead to an audit or take up time, or sometimes accounting mistakes become a hassle.

However, accounting mistakes can happen in both ways either it can be done intentionally or by accident. Intentional errors can become a major or serious criminal prosecution and it may cost more than expected.

But accidental errors tend to be honest mistakes due to some input errors and businesses can perform several steps in order to prevent them from occurring. Here are some tips and ways to avoid common small business accounting errors and improve your business process much better than before.

How to avoid accounting errors

Follow these simple steps and you can prevent various types of an accounting error that has made:

Always set a budget

It is suggested that you must set a budget for your business’s project. It helps you to easily track your money and you can avoid overspending. Without setting a budget, it is quite tempting to keep spending on your business to get success but later it can lead to cost spiraling out of control and if set a budget then it keeps our disciplined.

Record everything

Many businesses make a mistake of keeping their financial transactions/statements in one place. But they don’t consider the possibility of data loss, hardware error or accidental deletion that can render later and it made impossible to recover all the data. So it is important to safely store all financial transactions/statements in more than one place. Make your habit to keep a record of every single penny you spend.

Reconcile regularly

Reconciliation is a useful error rectification step that you can’t ignore. It helps you to easily notice an error of data entry and keeps you accurate. Reconcile your books regularly with your bank account is always a good idea in order to check for accuracy. With the help of this, you can sure about the balances of your bank statement and accounting records matches or not. Accurate statements make you take the right decisions so that you can proceed correctly further.

Keep your personal and business accounts separate

This makes you balance your accounts quite easier and you can keep easily track your money. This helps you to avoid overspending expenses on useless things.

Treating net profits and cash flow equally

Net profit and cash flow are related to income and expenses. But, there is a big difference in terms of evaluating money in both net profits as well as in cash flow. So it is suggested that keep it balanced.

Make use of technology

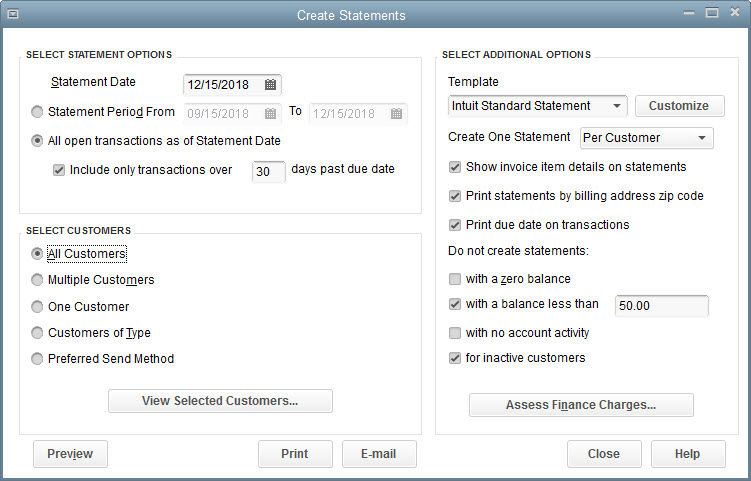

The business owner might be confused with technology and they fear to invest but it is not necessary to spend in the most expensive or most sophisticated software. You can go with a free trial to understand and make in use to get all the advantages of software. It also helps you to make work far easier and less time consuming and can get more benefits for your business.

Easy ways to avoid common small business accounting errors

Here are recommended a few steps to help you to reduce accounting errors in your business:

Make sure that your forms are more compatible so that employees can understand how to enter data in your accounting software

Appoint knowledgeable workers who have good control over data

Ensure that you just have enough workers to handle the employment.

Final Thoughts

Be aware of these common mistakes and try to avoid it as much as you can before they lead to get into trouble. It is important to take your business accounting seriously so that it helps you to avoid misplaced, deletion of financial records and loss of data. Don’t just let sloppy accounting practices and keep good control over the financial security of your business.

Source: http://bit.ly/2xxgPwC

Comments